SBP Issues NOC for new digital banking licensees. Almost nine months after 20 parties submitted bids for the five available digital banking licenses, State Bank has announced the winners.

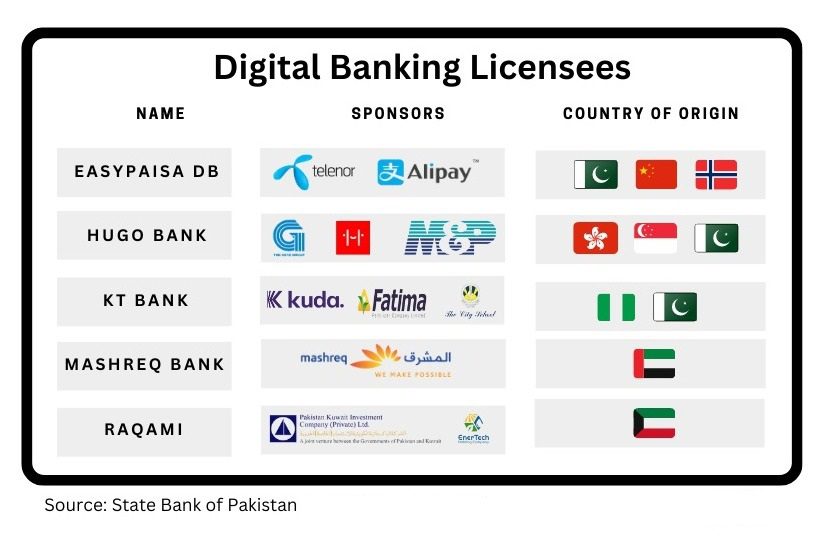

Technically it has issued No Objection Certificates to Easy Paisa, Hugo Bank, KT Bank, Mashreq Bank, and Raqami.

These groups will now have to incorporate a public limited company and then apply for in-principle approval.

Within the tech community, this has sparked some mixed reactions due to the exclusion of big names. For example, South Africa’s Tyme Bank, Sequoia-funded Dbank, and local fintech Finja all failed to get an NOC.

Instead, award recipients had strong representation from local business groups, such as City School Coda or M&P as one of the sponsors behind the Hugo.

On the positive side, none of the existing commercial banks made the cut.

Easypaisa DB

This is a name on the list that almost every Pakistani is familiar with.

4 million transactions per day and deposits of Rs 32 billion in 2022. The cost of funds in existing microfinance licenses is relatively high.

Its current branchless banking network of 190K is expensive to maintain, which could justify a shift to digital.

Easy Paisa, or technically Telenor Microfinance Bank, is in a pretty bad financial position.

Since 2018, it has been posting heavy losses – enough to wipe out the entire equity and survive only thanks to equity injections from sponsors.

On the one hand, Telenor Pakistan is reportedly looking for a buyer to exit the country.

Even Easypaisa was up for sale with MCB and UBL conducting due diligence on the company. On the other hand, they are backed by Alipay – the world’s largest fintech.

Hugo Bank

It is a joint venture between Getz Bros — Pharma, Pakistani courier M&P, and Atlas Consolidate, which operates Singaporean fintech Hugosave.

The only player with financial services experience here is Atlas, which has raised $10.5M in funding to date. They have reportedly amassed over 60,000 users (only) and recently received a Major Payment Institution (MPI) license in Singapore.

KT Bank

It is a joint venture between two Pakistani companies – Fatima Fertilizer and City School – and Nigerian fintech Kuda Bank.

Meanwhile, KudaBank has raised $90M+ and boasts 4M+ customers, according to its press kit. However, the bank lost $14M+ in 2021. Coda’s case is somewhat interesting as it brands itself as a money app for Africans – on the continent and elsewhere. How Pakistan fits into their plans is also unclear.

According to a media report, City School and Fatima Fertilizer are looking at use cases for education and agriculture while fintech will power the technology.

Fatima Group’s venture arm had already invested in TAG, a now-defunct digital wallet that was reportedly in the running for a license. It also expressed interest in acquiring Samba Bank.

Mashreq Bank

Mashreq is one of the largest banks in the Middle East, majority-owned by the Al Ghurair family of the United Arab Emirates.

As of 13 January, it had a market cap of AED 19.5B and reported a net profit of AED 2.6B in 9M2022.

However, the investor presentation did not mention the extent of its digital operations.

While the bank is looking to expand its footprint in Pakistan, even the latest communication mentions it in the context of offshoring.

While Mashreq is a strong sponsor on paper with relevant financial services experience, it is still a legacy bank. Very few such institutions have managed to pay digital dues. Also, it is quite strange that an institution of this size does not even report the number of its e-banking customers despite talking about a digital strategy.

Raqmi

Kuwait Investment Authority is the main sponsor here through Pak Kuwait Investment Company and Energetic Holding. KIA is a sovereign wealth fund with assets under management of $738B while PKIC reported a profit of ~PKR 7B during 9M2022.

KIA has been investing heavily in tech lately and counts the likes of Cream and Indiamart in its portfolio.

This can further increase the Pakistani market. Raqmi will be led by Nadeem Hussain, founder of Tameer Microfinance Bank and thus the brain behind EasyPaisa.

Earlier in 2021, PKIC also invested $3M in Planet N.

While the announcement has excited fintech enthusiasts, there is still a long way to go before we see these entities in action. SBP Issues NOC for new digital banking licensees. Even when these banks go live, it remains to be seen whether the State Bank’s objective of promoting financial inclusion can be achieved.